This data is produced by CTIA, Mobile Squared, Podium and Verified Market Research. The first chart goes back to before the pandemic effect, and shows that in 2017, marketers were still unlikley to consider spending to deliver messaging, with less than 10% of businesses willing to pay a premium for SMS/MMS - with email overwhelmingly the preferred solution

The Second Chart shows just how quickly that changed, and how by 2019 27% of businesses stated their willingness to pay a premium for Rich Text Messaging, with 35% of enterprise clients considering paying higher than email pricing to ensure delivery of messaging. This growth has been seen in 2020/21 in the US market, where Rich Text Message Marketing has taken off (probably a result of the Pandemic) and producing amazing ROI results, with users claiming 20% of their online revenues being generated from text message marketing, and $71.00 revenue per dollar spent.

This Chart breaks down the spend thresholds companies (large and small) are willing to consider for particular messaging types. This data points to the recognition of the value of visuals, guarateed delivery and very high open rates. Whilst email has been "free" the lower the open rate, the less value it has as a primary customer communication platform.

This Chart, is data released by the CTIA, which is the USA's mobile industry association. In this their 2021 report, they are reporting a 28% increase in the use of Rich Media Messaging in 20/21.

This chart shows that by 2028, MMS in the USA will be the same size as SMS is currently. This talks to the growth and opportunity with Rich Text Messaging taking over from email as the primary engagement platform between business and its clients. Further, this chart talks to the CAGR for MMS is significantoly steeper than SMS - no doubt due to the broader canvas of MMS enabling deeper more personalised brand and product messaging.

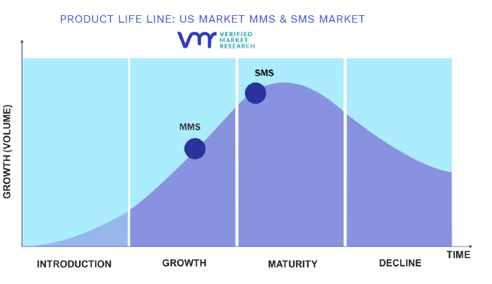

Many people who see this chart below may be reminded of Samuel Clements (Mark Twain) who is inaccurately quoted as having said "the reports of my death are greatly exagerated". MMS is alive, with a forecast of a strong future. MMS traffic did fall off a cliff in 2011, as a result of a number of contributing factors, including being overpriced, and all person to person image sharing moving to the OTT platforms like Facebook and WhatsApp in and around 2010 through to 2012. Around the same time, Apple had released the iPhone in 2007, Google launched free Gmail and MailChimp introduced a freemium plan. Consumers were signing up to personal email delivered to the smartphones by the millions which turned email froma B2B to a B2C platform in less than 5 years. In 2011 MMS was available only on smartphones, was still expensive and less than 30% of the consumer population had a smartphone. By 2011, the consumer email audience was much larger than the audience that could be reached by MMS. Add to this, email to consumer was the right price to a bigger audience and email became the default consumer engagement platform. So how does MMS now rate as being in the growth product life cycle category. Simply, MMS now is on over 6 billion smartphones, and in markets like Australia, USA, UK and France MMS has reached ubquity - the ability to reach close enough to 100% of the eligable population catapults MMS as a viable email replacement platform for personalised visual communication, its 2WAY, with guarateed receipted delivery, 98% of messages are seen , delivered over a point to point network direct to the mobile handset, addressed to an always on audience. MMS, with the right platform partner is easy to use, integrate to CDP and CRM, implement and track, and with its ubquity and ability to deliver a lot more canvas and visual content options than SMS - it will be a difficult platform for marketers to ignore.

This Chart speaks to why retail is the most immediate potential winner from text message marketing, we see the data here that in retail and online, A2P text can be used for Alerts, Customer Service, Path to Purchase and Marketing Campaigns.

This Chart was produced and published by Podium, and talks to the response rates achieved from text messaging vs other forms of comms. At MobileDigital we recently had a client do a side by side comparison against the same campaign on email, but using MMS and SMS. The client received 27 time the revenue from the text marketing campaign as they did from the email, and commented that this was the most successful campaign they had ever conducted, including campaigns using WhatsApp, FB, socials and search.